How much is BMW 3 Series car insurance?

The BMW 3 Series has been in production since 1975 and like most of the BMW model range it has enjoyed incredible worldwide success. The 1st and 2nd generation models are now sought after as classic cars and the BMW brand is world renowned for reliability, performance and drivability in the luxury and in this case the compact executive car market.

There have been 7 generations of the 3 Series model with each upgrade or facelift keeping the BMW styling we are all familiar with. BMW’s mission is “To move people with products that evoke emotions” and the engines that power them have always been responsive and powerful. This means that insurance premiums are not going to be cheap. The ABI groups the BMW 3 Series between group 18 and group 50.

If you want a cheap insurance premium and still want to drive a BMW choose a 316d SE (Insurance group 20) which has a diesel powered engine designed more for executive performance than evoking emotions!

If you want a BMW that has good performance and are not so worried about the cost of your insurance premium renewals, then a 320i Sport 4d petrol engine (Insurance group 30) will keep you interested.

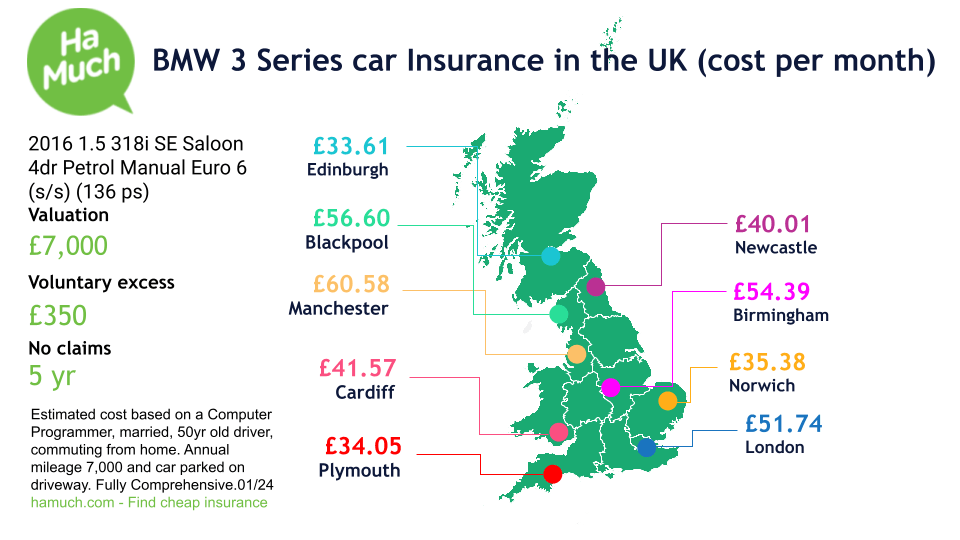

Bear in mind that your premium price is affected by where you live in the UK, so we have put together a table showing the estimated price of car insurance for a BMW 3 Series in UK towns and cities. It might be cheaper where you live.

We have run a quote for a 2016 1.5 318i SE Saloon 4dr Petrol Manual Euro 6 (s/s) (136 ps) valued at £7,000 with an insurance grouping of 21 to find you the cheapest insurance quotes for a 50 and 25 year old.

Cost of BMW car insurance renewal per month or year

50 Year Old Driver

- 2016 1.5 318i SE Saloon 4dr would cost approximately £54.22 a month or £579.59 per year for fully comprehensive cover for a 50 year old driver with 5 years no claims living in Reading, £350 voluntary excess and 7,000 miles per year.

25 Year Old Driver

- 2016 1.5 318i SE Saloon 4dr fully comprehensive insurance for a 25 year old with 5 years no claims and will cost approximately £104.80 a month or £1120.23 per year with a voluntary excess of £350.

These prices were based on quotes obtained from quotezone with Reading being the average benchmark for insurance costs in the UK. The cost of car insurance varies around the UK based on location.

Additional Information for quote:

- Manual transmission

- Not modified

- Used for social, domestic and commuting

- 7,000 mileage per year

- Parked on a driveway at night

The driver:

- Computer Programmer in Reading

- A homeowner

- No driving convictions

- 5 years no claims

- No driving offences

Where is BMW 3 Series car insurance cheap in the UK?

Click to see table of Estimated BMW 3 Series Insurance premiums around the UK

Where you live in the UK will affect your 3 Series premium cost because of crime and accident rates and the cost of getting your car repaired after an accident. Rural areas tend to be cheaper that larger cities.

*51% of consumers could save £504.25 on their Car Insurance. The saving was calculated by comparing the cheapest price found with the average of the next five cheapest prices quoted by insurance providers on Quotezones (Seopa Ltd’s) insurance comparison website. This is based on representative cost savings from September 2023 data. The savings you could achieve are dependent on your individual circumstances and how you selected your current insurance supplier.

*The estimations provided on this webpage are independently provided by HaMuch Ltd. Prices are not guaranteed and quotes may vary when using the comparison system based on individual circumstances.

Disclaimer: This information is intended for editorial purposes only and not intended as a recommendation or financial advice.

BMW car insurance renewal costs

| Job | Estimate |

| BMW 3 Series car insurance | £44.22 per month |

Compare BMW 3 Series car insurance renewal with other popular carjs

| Job | Estimate |

| Cheap car insurance | £40.00 per month |

| Ford Fiesta car insurance | £45.00 per month |

| Ford Focus car insurance | £53.06 per month |

| Young driver insurance | £104.27 per month |

| Over 50's car insurance | £20.69 per month |

| Convicted Driver Insurance | £48.50 per month |

| Vauxhall Astra car insurance | £49.46 per month |

| Nissan Qashqai car insurance | £52.79 per month |

| Black Box Insurance | £80.73 per month |

| BMW 3 Series car insurance | £44.22 per month |

| VW Golf car insurance | £52.75 per month |

| Nissan Juke car insurance | £57.14 per month |

| Vauxhall Corsa car Insurance | £51.39 per month |

| Ford Kuga car insurance | £75.00 per month |

| Ford Mondeo car insurance | £62.95 per month |